Improve your credit score the easy way

There are numerous credit score providers on the Internet which makes it confusing. But the FICO credit score is the main one consumers should concentrate on when they want to improve credit scores. That’s because FICO scores are used by 90% of top lenders when making lending decisions.

The abundance of information about how to improve credit scores can make the process more complicated than it really is. While there no quick fixes paying your bills on time is the No. 1 way to improve your credit scores. That means every debt MUST be paid on time without exception.

There is no trick or secret to improving credit scores even though the FICO scoring algorithms are complicated. Thirty-five percent of your score under FICO is your payment history.

The No. 2 way to improve your scores is to reduce your revolving debt. Revolving debt is debt owed on an account that the borrower can repeatedly use and pay back without having to reapply every time credit is used. Credit cards are the most common type of revolving account.

Credit card revolving debt includes credit accounts issued from banks, credit unions, retail stores and oil companies. Home equity lines of credit also known as a HELOC are considered revolving debt too.

Paying down your revolving debt is important because thirty percent of your score is derived from how much you owe. If you are carrying credit card debt month to month this is also dragging your score down. If you must carry debt, FICO recommends keeping your credit card debt at 30 percent or less of your available credit.

If you have a credit line of $1,000, you shouldn’t have more than $300 outstanding at any one time. Don’t use more than 30 percent of the total available credit you have. However for the highest credit scores it is recommended that you do not use more than 7 percent of your total available credit.

It’s really that easy to improve your credit scores. Don’t fall for the tricks you hear about or receive in your email inbox from companies promising to fix your credit. You can do it yourself…for free!

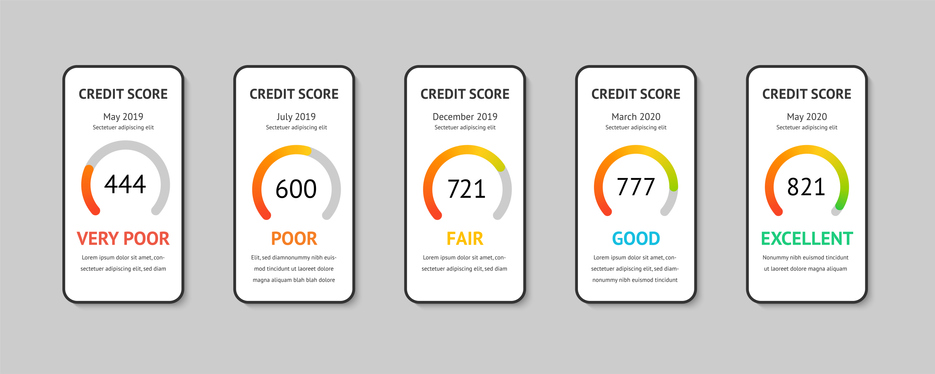

Here’s what many people don’t seem to get about the FICO credit scoring model. FICO is fluid, not static. As you pay your bills on time and pay off debt, you are helping to improve your credit score as often as your creditors report what you’re doing to the credit bureaus.

That means you can improve your credit in as little as 30 days or every time your creditors report new, positive information like on-time payments and lower account balances.

Improve your credit score the easy way.